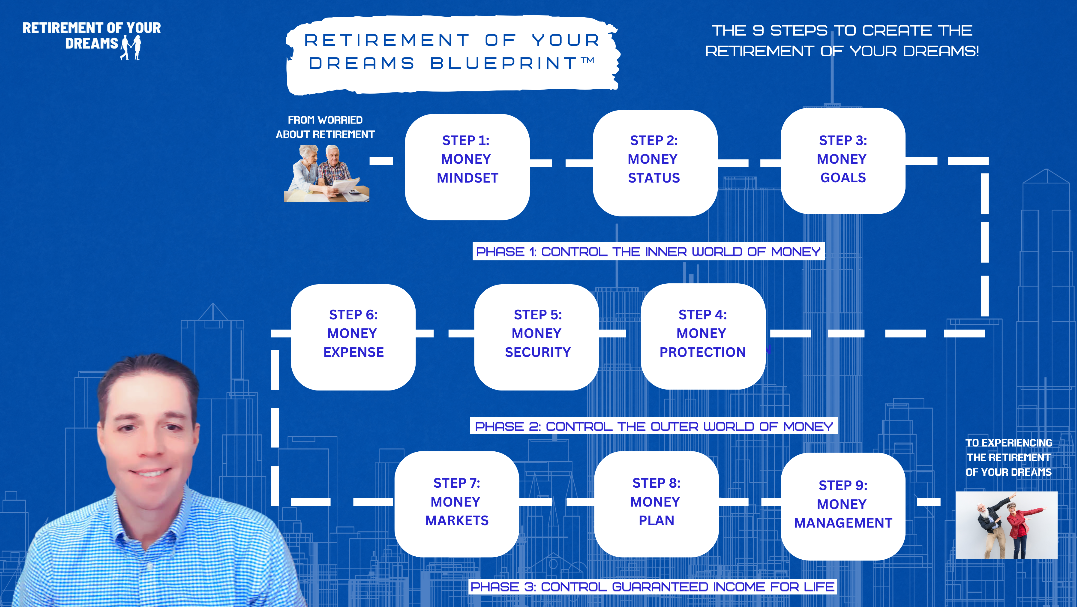

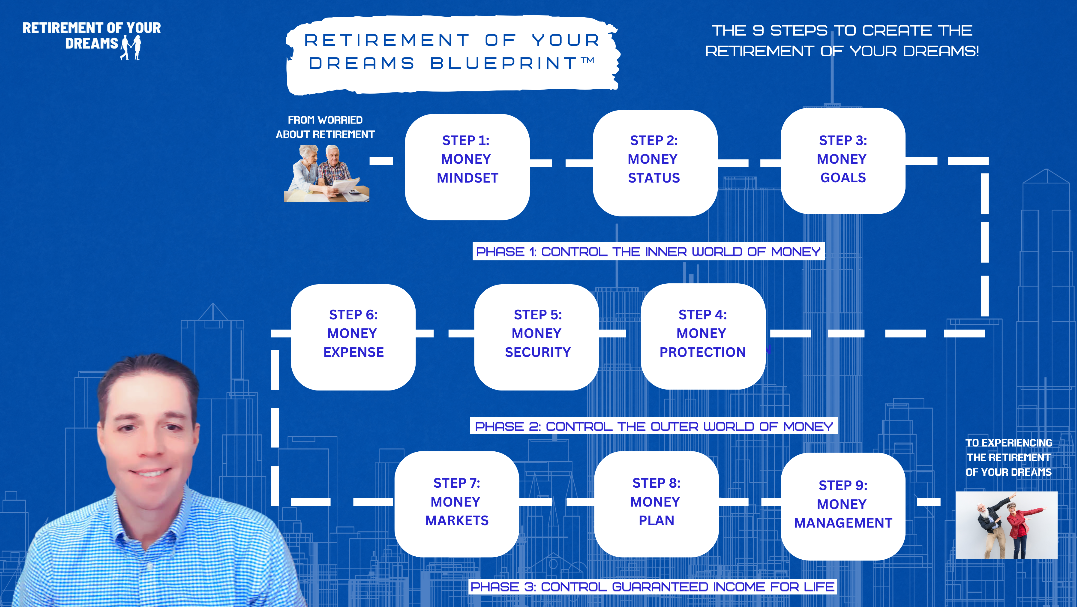

DISCOVER THE 9 STEPS OF

THE RETIREMENT OF YOUR DREAMS BLUEPRINT™

PARTNERED WITH ...

Retirement Of Your Dreams Blueprint™

Most people approach retirement with a mix of hope, assumptions, and unanswered questions.

They save what they can.

They follow generic advice.

They trust that things will somehow “work out.”

But retirement doesn’t fail because people don’t work hard.

It fails because they were never shown how to turn what they’ve built into income, security, and peace of mind that lasts for life.

The Retirement Of Your Dreams Blueprint™ is a structured, 3-phase, 9-step framework designed to remove guesswork from retirement planning ...

... and replace it with clarity, protection, and confidence.

This isn’t about chasing returns or predicting markets.

It’s about building a retirement plan that works regardless of markets, taxes, inflation, or how long you live.

Who The Retirement Of Your Dreams Blueprint™ Is For

The Retirement Of Your Dreams Blueprint™ is designed for individuals and families who want to stop guessing ...

... and start making intentional, informed retirement decisions.

This is for you if:

• You are within 5–10 years of retirement and want certainty, not surprises

• You are already retired and worried about income, taxes, or rising costs

• You’ve saved responsibly but don’t know how long your money will last

• You’re concerned about healthcare, long-term care, or unexpected life events

• You want guaranteed income you can rely on ... not just account balances

• You want a clear plan instead of fragmented advice from multiple professionals

This blueprint is especially valuable if you want to understand how all the moving parts of retirement fit together ... before it’s too late to course-correct.

Who The Retirement Of Your Dreams Blueprint™ Is NOT For

The Retirement Of Your Dreams Blueprint™ is NOT designed for everyone ... and that’s intentional.

This is NOT for you if:

• You're looking for speculative or high-risk strategies

• You want “hot tips,” shortcuts, or market predictions

• You're unwilling to plan beyond short-term performance

• You believe retirement planning is only about accumulating assets

• You want ideas without structure or follow-through

This blueprint is built for people who value stability, foresight, and long-term security.

The BIG Picture

This phase establishes clarity and direction ... without which no financial strategy can succeed.

Your beliefs about money influence every decision you make in retirement.

Many people unknowingly operate from fear, scarcity, or outdated assumptions ...

... leading to hesitation, procrastination, or avoidance.

This step empowers you to reframe how you think about money, so decisions are driven by logic, clarity, and long-term thinking.

Outcome: You approach retirement planning with confidence instead of anxiety.

Before you can plan effectively, you must clearly understand where you are today.

This step brings all assets, income sources, and obligations into one organized picture ...

... removing confusion and blind spots.

Most people are surprised by what they discover here.

Outcome: You know exactly what you have, how it’s positioned, and where potential risks exist.

Retirement success isn’t accidental ...

... it’s defined.

This step empowers you to clearly articulate what your dream retirement looks like across short, mid, and long-term

horizons.

Income, lifestyle, legacy, and flexibility are all considered.

Outcome: You have a clear destination and measurable targets instead of vague expectations.

This phase focuses on protecting and securing the foundation you’ve built.

Unexpected events ... healthcare costs, inflation, market downturns ...

... are the biggest threats to retirement.

This step ensures your plan accounts for risks that quietly derail most retirees.

Outcome: Your retirement strategy is resilient against events that destroy unprotected plans.

Accumulated assets do not equal retirement security.

This step focuses on converting portions of your assets into guaranteed income sources that last as long as you do.

This is where peace of mind is created.

Outcome: You no longer worry about outliving your money.

Taxes, fees, and inefficiencies quietly drain retirement income.

This step identifies where money is leaking out ...

... and restructures your plan so more of what you’ve earned stays with you.

Outcome: Your retirement income becomes more efficient, predictable, and sustainable.

This phase ensures your plan holds up over time ... not just on paper.

Market exposure is most dangerous in the years surrounding retirement.

This step focuses on managing risk intelligently, so volatility doesn’t force lifestyle changes later.

Outcome: Market downturns no longer dictate your quality of life.

Here, everything is structured into a cohesive income strategy.

Assets are positioned intentionally so income is stable, predictable, and aligned with your goals.

Outcome: Your retirement income works like a dependable paycheck.

A retirement plan must evolve as life changes.

This step ensures your plan is reviewed, adjusted, and optimized over time ...

... so, it remains aligned with reality.

Outcome: Your retirement stays on track no matter what life throws your way.

The Bottomline:

When all 9 steps work together, you experience:

• Predictable income for life

• Reduced tax exposure

• Protection from major financial risks

• Clarity in every retirement decision

• Peace of mind for you and your family

This is how the Retirement Of Your Dreams becomes achievable ...

... and sustainable.

Address:

10808 S. River Front Parkway #3114

South Jordan, UT 84095

Phone:

214-277-1890

SITEMAP

Privacy Policy | Terms and Conditions

Disclosure: This information is provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. The real life case scenarios presented should not be deemed a representation of past or guarantee future results. To the extent that this information concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstance.

Copyright 2021© Jason Bergquist Financial, LLC. All Rights Reserved.